Irs Fire System Test File

Form 8809 Extension of Time to File Information Returns is also available as a Fill-in Form at httpsfireirsgov. The file will be released after 10 calendar days.

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

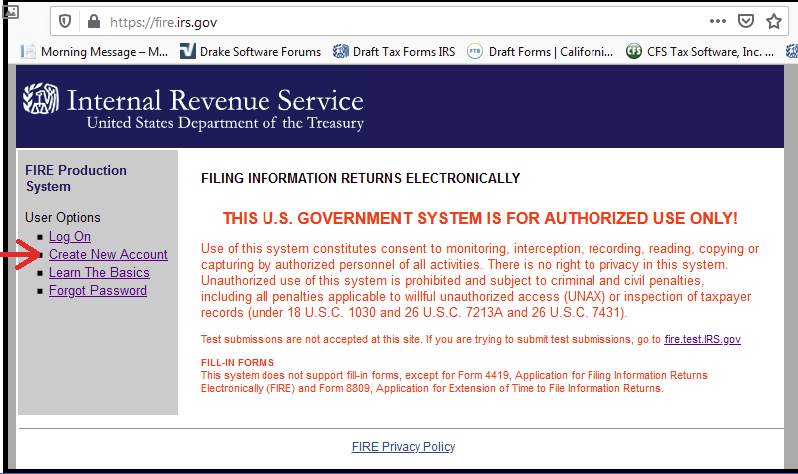

About The IRS FIRE System The FIRE System is a website httpfireirsgov maintained by the Internal Revenue Service IRS that you can use to electronically file your IRSTAX file directly with the IRS.

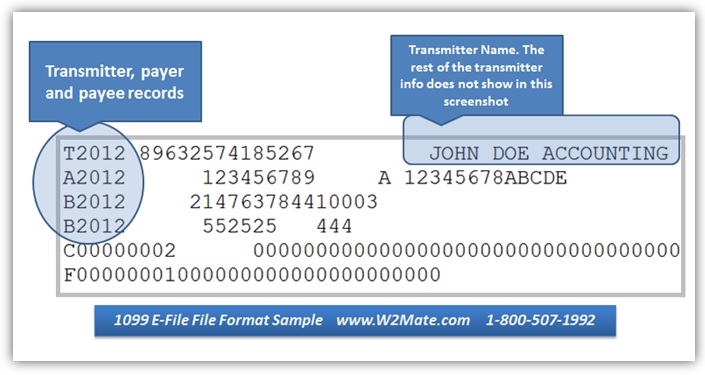

Irs fire system test file. The submission needs to be a flat file and it includes records such as Transmitter T Payer A Payee B End of Payer C State Totals. Unauthorized use of this system is prohibited and subject to criminal and civil penalties including all penalties applicable to willful unauthorized access. IRS Resources The IRS maintains documentation for their FIRE system.

Submit Form 4419 by November 1 2020 to ensure you are ready to electronically file in Tax year 2021. The FIRE System does not provide fill-in forms for information returns. FILL-IN FORMS This system does not support fill-in forms except for Form 4419 Application for Filing Information Returns Electronically FIRE and Form 8809 Application for Extension of Time to File Information Returns.

1220 an IRSTAX file can contain either a single filer or multiple filers. How to Use the IRS FIRE System. Benefit from a electronic solution to create edit and sign documents in PDF or Word format online.

Otherwise you can enter your assigned User ID and the. Publication 1220 - Internal Revenue Service Aug 31 2016. Electronic filers will find a link to the IRS FIRE System on the Module menu.

IRS does not provide an electronic fill-in form option for filing information returns. If within this 10 day timeframe you find out that made any errors with this file. Enter your TCC and TIN.

I am trying to submit my clients 1099s through the IRS FIRE system but am not sure how to convert the PDF file created from QuickBooks to an approved file for submitting through the FIRE system. In either case a single IRSTAX file can contain various. First and foremost the IRS needs a way to verify that the electronic submissions they receive are coming from the businesspayer.

Information put and request legally-binding digital signatures. This is the application for obtaining a Transmitter Control Code TCC which helps the IRS keep the system secure. To do this the IRS requires payers to file Form 4419.

FILL-IN FORMS This system does not support fill-in forms except for Form 4419 Application for Filing Information Returns Electronically FIRE and Form 8809 Application for Extension of Time to File Information Returns. Where can I find the file to be transmitted to the IRS FIRE System. FILL-IN FORMS This system does not support fill-in forms except for Form 4419 Application for Filing Information Returns Electronically FIRE and Form 8809 Application for Extension of Time to File.

Good Not Released If the payee count is also correct then you the filer are finished with this file. Use of this system constitutes consent to monitoring interception recording reading copying or capturing by authorized personnel of all activities. Does anyone use the FIRE system and QuickBooks Pro.

Convert them into templates for numerous use incorporate fillable fields to gather recipients. To file 1099 forms electronically you must have software that generates a file according to the specifications in Publication 1220. However the IRS encourages the submission of a test file.

Then click on Search. IRS FIRE Home If you are trying to submit test submissions go to firetestIRSgov. Note that there is no www in the address For information on the system please see the FIRE brochure IRS Publication 3609 in pdf format.

Submit an online Fill-in Form 4419 located within the FIRE System at httpsfireirsgov. GOVERNMENT SYSTEM IS FOR AUTHORIZED USE ONLY. FIRE Test System User Options.

As of October 1 2019 Form 4419 is mandated to be electronically filed when requesting an original TCC. There is no right to privacy in this system. If you are trying to submit test submissions go to firetestIRSgov.

The IRS FIRE Test System is only available for part of the year. Although a test file is only required for the first year its highly recommended that a test file be sent every year. Simply upload this file to IRSIRB via The IRS FIRE System.

Log in the httpfireirsgov. It is available from the IRS. User ID Password You will need a User ID and Password to begin using this application.

If you are trying to submit test submissions go to firetestIRSgov. Then click on Check File Status. IRS FIRE Home Test submissions are not accepted at this site.

The FIRE system allows you to submit 1099s electronically via the Internet. Testing typically is available from November 1 through mid-March. Click to get to the Main Menu.

The file you send to the IRS FIRE System is named IRSTAX. Not required to submit a test file. Irs fire test system dates.

If the CFSF test file is acceptable the IRS will send the filer a letter of approval. You must submit one Good test file and then call the IRS at 866-455-7438 x3 and provide your TCC and the successful test file name and they will mark your TCC number as one that can participate in the Combined FederalState Filing. Or a person who is duly authorized to sign a return.

Submit an online Fill-in Form 4419 located within the FIRE System at httpsfireirsgov. Do the job from any device and share docs by email or fax. Use this IRS FIRE software to file 1099 forms electronically through the Filing Information Returns Electronically system FIREIRSGOV.

If you do not already have an account click Create New Account to start setting up your new account. You must submit a test file if you are filing for the first time under the Combined FederalState Filing Program CFSFP. The Web address of the system is httpfireirsgov.

If the results indicate. Fields with an are required. A FIRE test file properly coded for the program is required when applying to participate in CFSF Program.

The steps for checking the file status are as follows. If you file fewer than 250 you may submit them electronically with the FIRE system or you may submit them manually by mailing Copy A to the IRS. CFSF records must be coded using the two-digit codes assigned to the participating states from the.

1099 Software User Guide Note This Is Intended To Be A General Guide To Introduce You To The Ftwilliam Com 1099 Software Features And Structure More Details Are Often Provided At Ftwilliam Com And Through Free Webinars Preformed Throughout The Year At

1099s Electronic Filing How To Upload 1099s Efile To Irs Site

1099s Electronic Filing How To Upload 1099s Efile To Irs Site

4 21 1 Monitoring The Irs Program Internal Revenue Service

1099 Combined Federal State Program E Filing Das 1099

1099s Electronic Filing How To Upload 1099s Efile To Irs Site

1099 E File Format Specification File Layout

Applying For A Transmitter Control Code Tcc Cfs Tax Software Inc

Https Www Irs Gov Pub Irs Pdf P1516 Pdf

1099s Electronic Filing How To Upload 1099s Efile To Irs Site

W 2g User Interface Certain Gambling Winnings Data Is Entered Onto Windows That Resemble The Certificate Of Participation Template Federal Income Tax Irs

1099 Electronic Filing How To Upload 1099 Efile To Irs Site

Extension Of Time To File Information Returns Das 1099 W2

Irs Launches Get My Payment Tool To Track Your Stimulus Payment Krqe News 13

Account Ability Includes Bulk Tin Matching For Free Account Ability Creates Bulktin Transmittals Pursuant To Irs Pub 2108a A Single Bu Fake Money Irs Efile

4 21 1 Monitoring The Irs Program Internal Revenue Service

4 21 1 Monitoring The Irs Program Internal Revenue Service

4 21 1 Monitoring The Irs Program Internal Revenue Service

Post a Comment for "Irs Fire System Test File"